FBT, Deductions & GST: Christmas Party & Gift Tax Rules for Australian Businesses

The festive season is meant for celebrating your team and clients — but for business owners, it can also be a source of stress. How do you throw a generous year-end party or give thoughtful gifts, without creating a tax nightmare?

Don’t worry, we’ve got you. We’re going to answer all your gifts, party, and holiday tax questions in a simple, skimmable FAQ format. By the time you finish reading, you’ll know how to reward your team and impress your clients without any tax hangovers.

The Most Important Question to Ask is This

Is your party going to be fun, away from the office and something your team are going to enjoy and remember?

If yes, you need to get comfortable with the idea that it’s going to cost you a bit more than you think. It’ll likely be either non deductible, or deductible with FBT payable… but you’re not really doing all this celebrating as a cost saving exercise now, are you?

So plan accordingly and remember to support small businesses and our friends in hospitality.

1. Fringe Benefits Tax (FBT) Basics

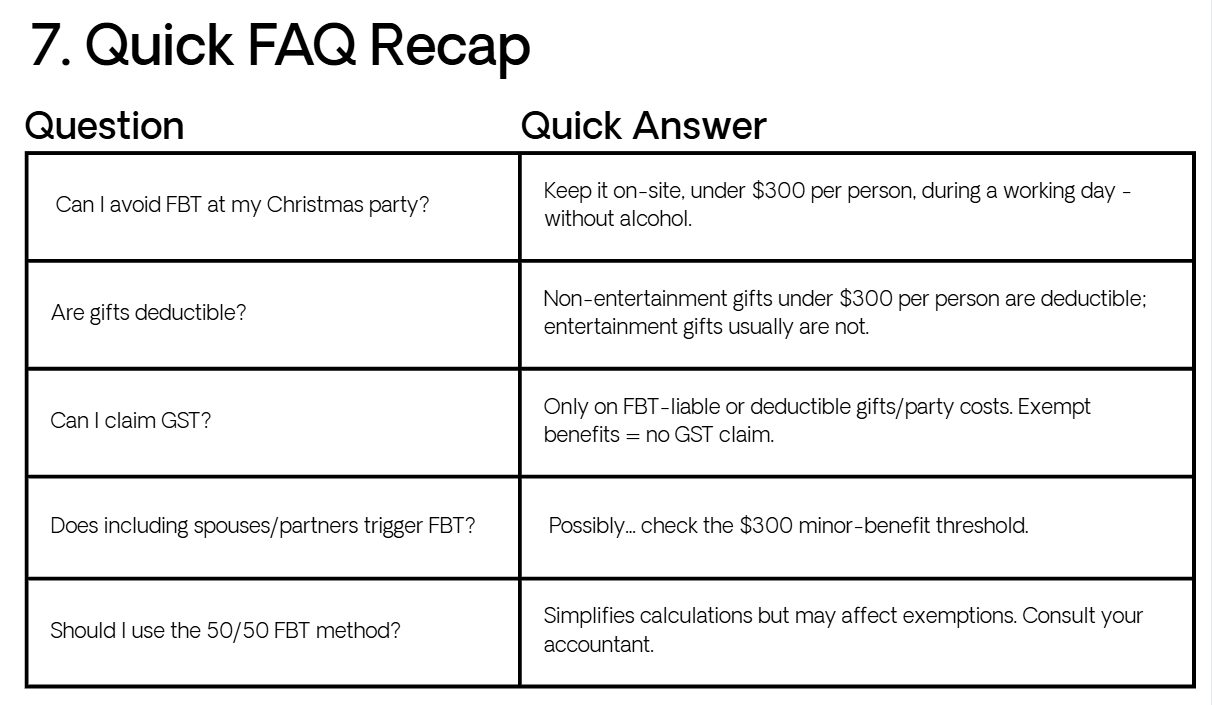

Q: What is FBT?

A: FBT is the tax your business pays on benefits provided to employees or their associates… like gifts, parties, or entertainment.

Q: Why does it matter at Christmas?

A: Festive spending can trigger FBT or exemptions depending on cost, type, and location. Getting it wrong can result in extra tax bills or lost GST claims.

2. Christmas Party Rules

Q: If I host a Christmas party, do I pay FBT?

A: It depends:

On-site, working day party: Usually FBT-exempt, but no deduction or GST (and no alcohol).

Off-site or includes guests/associates: FBT may apply if the cost per person is over $300 (minor-benefit exemption threshold).

Q: Can I claim a tax deduction for my party?

A: Only if FBT applies. On-site exempt parties are not deductible.

Q: Does including spouses or partners change FBT?

A: Possibly… their costs may trigger FBT if over the $300 minor-benefit limit - keep it at $299 or under for this one.

3. Employee Gifts

Q: What gifts are FBT-exempt?

A: Non-entertainment gifts under $300 per person:

Hampers

Store gift cards

Flowers

Q: What gifts are not exempt?

A: Entertainment gifts like concert tickets, event passes, or experiences usually trigger FBT and are not tax-deductible.

Q: Can I claim GST on gifts?

A: Only on gifts that are deductible or FBT-liable. Exempt minor benefits = no GST claim.

4. Client Gifts

Q: Do I pay FBT on client gifts?

A: Usually no, unless the recipient is also an employee or their relative/partner.

Q: Are client gifts deductible?

A: Non-entertainment gifts are generally deductible and may allow GST credits. Entertainment gifts may not be deductible.

5. Cost Thresholds & Rules

Q: What’s the $300 minor-benefit exemption?

A: Benefits under $300 per person (we’re talking $299 maximum here) may be exempt from FBT. Each benefit is assessed separately (party vs gift).

Q: How do I calculate per-person costs?

A: Include all related costs: food, drinks, venue, transport, and entertainment. Keep detailed invoices.

6. Tax-Smart Holiday Tips

Plan early: Know your budget and FBT exposure.

Break down costs per person: Helps apply exemptions and GST claims correctly.

Choose gifts carefully: Non-entertainment gifts under $300 are safest.

Document everything: Guest lists, receipts, and benefit valuation.

Talk to your accountant: They can structure gifts and parties for maximum tax efficiency.

Key Takeaways

$299 per-person threshold is your key to minimising FBT.

On-site, working-day parties are often FBT-exempt, but not deductible.

Gifts are assessed separately - non-entertainment gifts under $300 are safest.

Exceeding exemptions may trigger FBT, but allows tax deductions and GST credits.

Document everything and seek professional advice to avoid surprises.

Need Help With Your Business Holiday Spending?

Planning your Christmas party, gifts, and end-of-year bonuses shouldn’t be stressful. If you have any questions about tax, FBT, GST, or deductions for your business, we’re the people to talk to.

Our team helps business owners plan smarter, save money, and stay compliant… so you can focus on celebrating your team - not the paperwork.

Talk to us and make your holiday spending stress-free.